It’s been a challenging couple of years for companies looking to raise capital. When I speak with clients who are short on cash, I often advise them to take a closer look at their cash conversion cycle (CCC) as a way to extend runway. Every industry has its own CCC dynamics, but there are always ways to improve CCC. In this post, I’ll guide you through the mechanics of CCC, using DTC e-commerce and SaaS as industry examples, and I’ll explain the levers you have to optimize CCC and extend your runway.

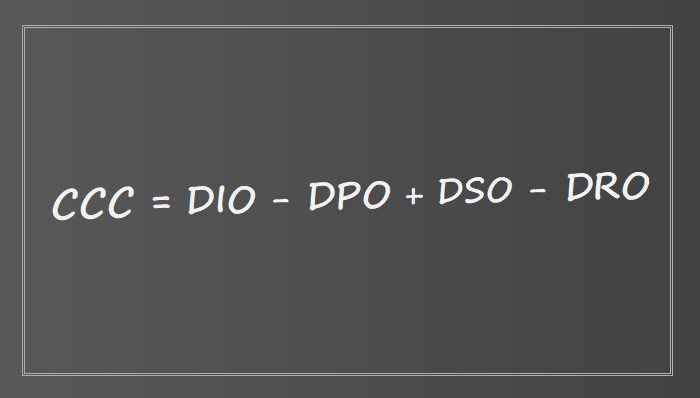

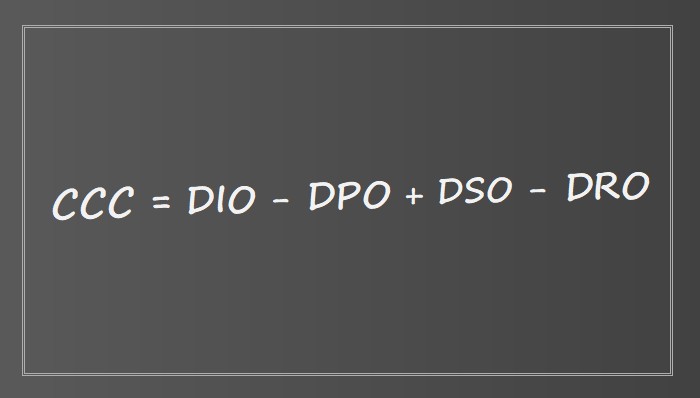

First let’s start with the basics. Your cash conversion cycle (CCC) measures how long it takes to convert cash into a product or service and back into cash again. The standard formula is CCC = DIO – DPO + DSO. Below, I’ve introduced a fourth term that often ignored — DRO — to capture deferred revenue, leading to the formula:

CCC = DIO – DPO + DSO – DRO

Let’s define each component:

Days Inventory Outstanding (DIO): The time it takes to sell your product. It applies to businesses with physical goods — e.g., a DTC apparel brand or an auto parts manufacturer. It doesn’t apply to software or services in most cases.

Days Payable Outstanding (DPO): The time it takes to pay your product suppliers. Again, most relevant for companies that produce and/or sell physical goods. Suppliers may produce finished products or supply components used in the final product.

Days Sales Outstanding (DSO): The time it takes customers to pay (after being invoiced). Your customers can be other businesses or end consumers.

Deferred Revenue Outstanding (DRO): You don’t often see this as part of CCC, but it’s incredibly important. DRO is the time between invoicing the customer and recognizing revenue. For SaaS businesses billing annually in advance, DRO can be significant. DTC e-commerce businesses also have positive DRO — although not usually as significant — because the order is shipped to the customer days or weeks after purchase.

Now let’s look at CCC dynamics using two example industries: DTC e-commerce and SaaS. As you’ll see they’re quite different.

CCC for a DTC E-commerce company

DIO typically includes the time it takes to move goods from the factory to your warehouse and the time it takes to sell and ship those goods to the customer (at which point revenue is recognized). DIO can vary a lot depending on the location of the factory and the sales velocity of the goods. It’s not unusual to see DIO of 60-90 days. If you purchase your goods from factories overseas, your unit costs may be lower, but the time it takes to move goods to your warehouse will be longer, and this will increase DIO. Products with high sales velocity, like fashion apparel and pet treats, have lower DIO. Products with low sales velocity, like furniture or high-end jewelry, have higher DIO.

DPO depends on the payment terms you’ve negotiated with your product suppliers. Payment terms can vary a lot, depending on order volume and industry. DTC startups often pay a deposit when they place an order with their supplier and then pay the balance once the goods are produced. More mature DTC companies can have 30-45 days to pay their suppliers.

DSO depends on your payment terms with customers. For B2B customers, typical payment terms are 30-45 days, although some B2B customers negotiate payment terms as high as 60-90 days. For B2C customers, typical payment terms are 0 days as the customer usually pays when they place an order.

DRO represents the time between when the order is placed and when the order is shipped (at which point revenue is recognized). For most DTC companies, this is 2-5 days. If you run pre-sales or experience shipping delays, DRO can be higher, which improves CCC.

In DTC e-commerce, CCC can vary a lot depending on industry segment and company size. Consider a small B2C furniture brand that manufactures chairs in Sweden and sells them to discerning interior designers. This business has high DIO, low DPO, and high DSO, leading to a high CCC. This company would find it difficult to scale because a lot of its cash is tied up in inventory and accounts receivable. Now consider a large B2C pet food brand that manufactures in the U.S. and sells directly to end consumers. This business has low DIO, better DPO, and low DSO. This company would have less cash tied up in the business and could grow more quickly without raising outside capital.

CCC for a SaaS company

DIO is zero, since the company has no physical products and no inventory. This is a key benefit of operating a SaaS business.

DPO is zero. Since the company has no physical products, it has no product suppliers.

DSO depends on payment terms with customers. Most SaaS companies sell to businesses, which typically have 30-45 days to pay; some B2B customers may negotiate payment terms as high as 60-90 days. Some SaaS companies sell to consumers, which pay right away.

DRO tracks the time between invoicing customers and recognizing the revenue. If you offer an annual subscription that is paid for upfront, DRO can be significant.

CCC tends to be a lot lower for SaaS than for DTC. Without inventory to produce and pay for, SaaS companies are able to avoid two of the four components of CCC!

Improving CCC in DTC E-Commerce

Looking at the components of CCC for DTC e-commerce, there are a number of levers to reduce your conversion cycle and improve runway.

Inventory management: To reduce DIO, a DTC company should seek to minimize its Inventory Weeks on Hand. Inventory Weeks On Hand (otherwise known as Weeks Of Supply) is calculated by looking at a company’s inventory level compared to its projected future COGS, typically over the next three months. It’s a simple metric that allows companies to track the dollar value of inventory sitting at the warehouse relative to projected future demand.

Just-in-time inventory: Some DTC companies can reduce CCC by producing the product after receiving the customer order. By producing the product after the order is placed, a company can reduce its DIO to zero and reduce CCC. This tends to work in certain industries, such as high-end furniture and luxury automobiles, where products are customized and customers are used to long order-to-ship times.

Trade Financing: Trade financing can accelerate cash conversion of supplier payments and customer payments. Traditional merchant cash advance providers can be prohibitively expensive for small companies. Newer providers like Settle offer 30-90 day cash advances at more reasonable interest rates.

Letter of credit financing: To improve DPO, you can look into using letters of credit issued by a commercial bank. A letter of credit (LC) is an IOU issued by a bank to your supplier. LCs are typically issued as part of a credit facility with the issuing bank. The LCs reduce the available balance on the credit facility, or if there is no credit facility, you typically must hold an equivalent amount of cash as restricted cash at the bank while the LC is outstanding. Because an LC is guaranteed by a bank, suppliers are willing to accept longer payment terms – often as long as 90 days. Suppliers are also often able to borrow against the LCs to fund their own cost of materials.

Supplier payment terms: We recommend having conversations with suppliers about payment terms once a year if order volume is increasing. As order volume increases, so does your leverage to negotiate better payment terms with suppliers. Suppliers are looking for growth and navigating their own competitive market, just like you. From the supplier’s perspective, a growing customer is a good customer, and they’re likely to accept less favorable terms to keep a good customer. To gain even more leverage, I advise clients to spend the time to find alternative suppliers.

Pre-sales: Some DTC companies reduce CCC by selling products before they’re in stock. This tends to work for products in high demand with scarcity value. This sales tactic can lower DIO significantly and even lead to negative DIO.

Improving CCC in SaaS

A SaaS company has fewer levers to improve CCC, but they are no less important.

Upfront vs monthly customer payments: Many SaaS companies offer customers a choice between upfront annual payment or monthly payments, with the latter being 10-20% more expensive. This pushes many customers to opt for the upfront annual payment. Annual upfront payments increase DRO a lot, which reduces CCC.

Customer payment terms: Negotiating more favorable payment terms with customers can be difficult, but it’s worth a mention here. The best time to negotiate terms is during the initial contract negotiation process. Once a contract is signed, it becomes challenging to change terms, even upon renewal. One tactic is to identify your least profitable customers and, upon renewal, notify them that their payment terms will need to change. Another important lever is enforcing your existing payment terms. Sending frequent reminders about overdue invoices can help. Likewise, a conversation with the customer’s CFO or Controller can do the trick.

The limitations of CCC

We haven’t yet talked about the limitations of CCC. Here are a few worth mentioning.

CCC does not account for the product margin you generate when you sell your product. CCC only accounts for the timing of cash spent and cash received. But a company with higher product margins generates more cash from the sale of their product, so would have less capital tied up in the business, all else equal.

We didn’t get into the details of how to calculate CCC’s components. The calculations you’ll find online typically use numbers from the P&L and Balance Sheet to estimate DIO, DPO, and DSO. The results from these calculations are approximations at best and tend to work better when benchmarking CCC across a group of companies. For finance professionals, I recommend using a bottoms-up approach to calculating CCC. For DIO, estimate the time in days between when the goods leave the factory, when they arrive at the warehouse and when they are sold and shipped. For DPO and DSO, list out your suppliers and customers and calculate the weighted average payment term in days. For DRO, if you’re a SaaS company, you’ll need to calculate the weighted average duration of revenue recognized. For an annual subscription paid upfront, DRO is approximately 160 days. For an annual SaaS subscription paid monthly, DRO is zero. For a DTC e-commerce company, DRO will depend on whether you do any pre-sales. If not, DRO is simply the average order-to-ship time in days.

About the Author:

Karsten Loose is co-founder and Managing Partner at Karlon Group, a fractional finance and accounting firm that helps companies build, scale, and optimize their finance and accounting functions. Karlon Group works with companies across SaaS, consumer, manufacturing and technology, offering a full suite of finance and accounting support tailored to each client’s changing needs.